In today’s increasingly complex business environments—subject to strict regulations—optimising the financial consolidation process is a real necessity. Its very nature—structured, technical, and data-intensive—requires a high level of expertise, control, and automation. This is not only to ensure compliance with current regulations, but also to significantly enhance the operational efficiency of the finance function.

What is the Financial Consolidation Process?

The financial consolidation process involves aggregating accounting and financial data from multiple legal entities (companies) within a group, in order to present a unified view of the group’s financial performance and position. This inherently complex process includes not only the combination of individual financial statements but also currency conversion (when needed) and the elimination of intercompany transactions to avoid double-counting and misrepresentation in the final report.

Many large organisations are required to prepare consolidated financial statements. Publicly listed groups or those of significant size must comply with strict standards such as the IFRS (International Financial Reporting Standards), which provide detailed guidelines for consolidation criteria, methods, and principles. Consolidated financial statements are critical not only for compliance, but also:

-

- As a support for strategic decision-making, allowing the identification of high-margin areas,

inefficiencies, or risks across different business units.

- For financial communication with banks, rating agencies, and regulators,

who rely on the consolidated report for their assessments.

- To provide transparency to the market and investors.

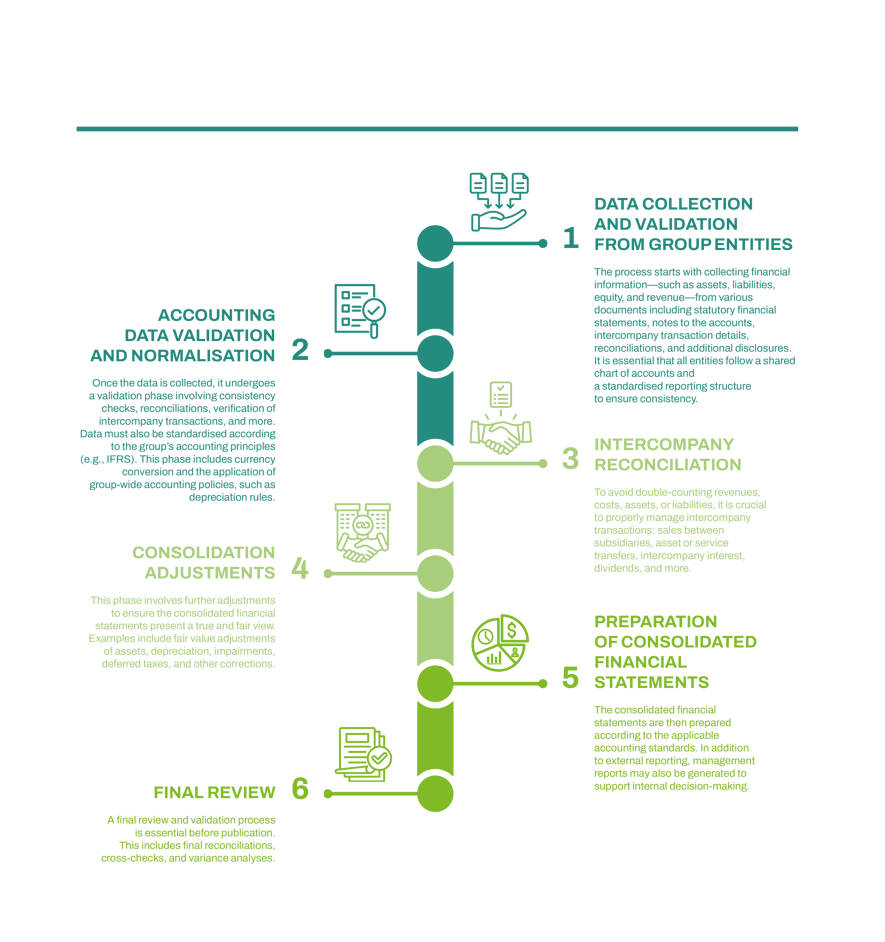

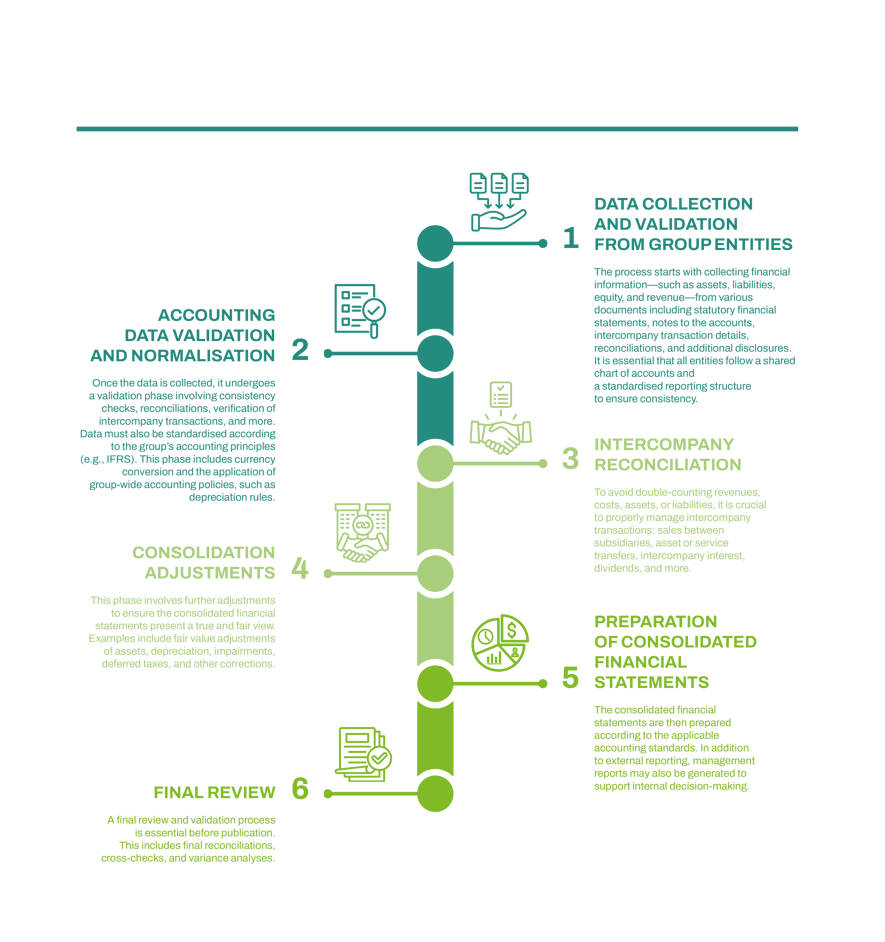

Key Phases of the Financial Consolidation Process

The financial consolidation process is structured and tightly regulated. Each phase must comply with rigorous accounting principles to ensure consistency, transparency, and data traceability.

· Data Collection and Validation from Group Entities

The process starts with collecting financial information—such as assets, liabilities, equity, and revenue—from various documents including statutory financial statements, notes to the accounts, intercompany transaction details, reconciliations, and additional disclosures. It is essential that all entities follow a shared chart of accounts and a standardised reporting structure to ensure consistency.

· Accounting Data Validation and Normalisation

Once the data is collected, it undergoes a validation phase involving consistency checks, reconciliations, verification of intercompany transactions, and more. Data must also be standardised according to the group’s accounting principles (e.g., IFRS). This phase includes currency conversion and the application of group-wide accounting policies, such as depreciation rules.

· Intercompany Reconciliation

To avoid double-counting revenues, costs, assets, or liabilities, it is crucial to properly manage intercompany transactions: sales between subsidiaries, asset or service transfers, intercompany interest, dividends, and more.

· Consolidation Adjustments

This phase involves further adjustments to ensure the consolidated financial statements present a true and fair view. Examples include fair value adjustments of assets, depreciation, impairments, deferred taxes, and other corrections.

· Preparation of Consolidated Financial Statements

The consolidated financial statements are then prepared according to the applicable accounting standards. In addition to external reporting, management reports may also be generated to support internal decision-making.

· Final Review

A final review and validation process is essential before publication. This includes final reconciliations, cross-checks, and variance analyses.

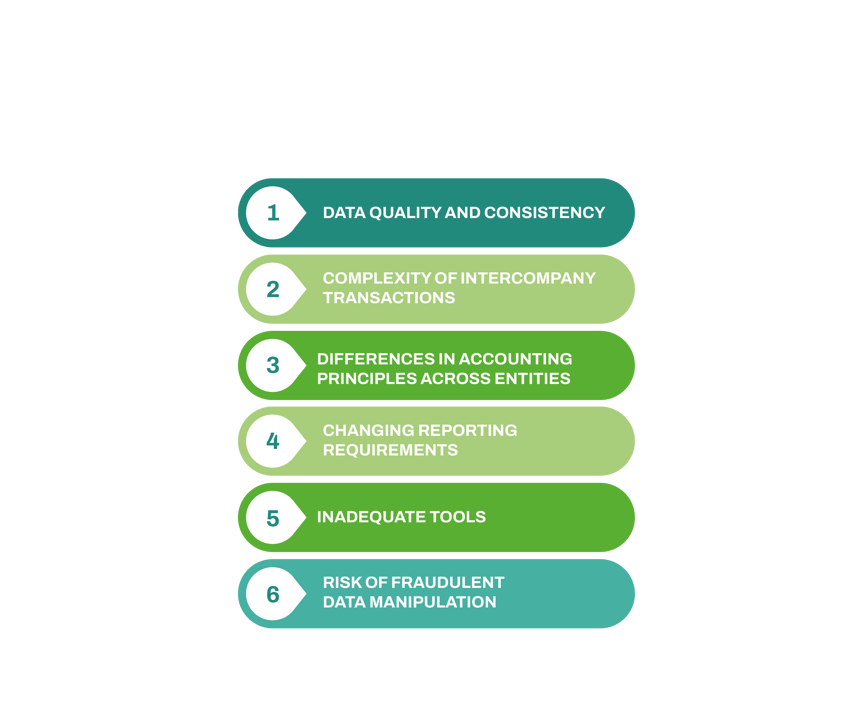

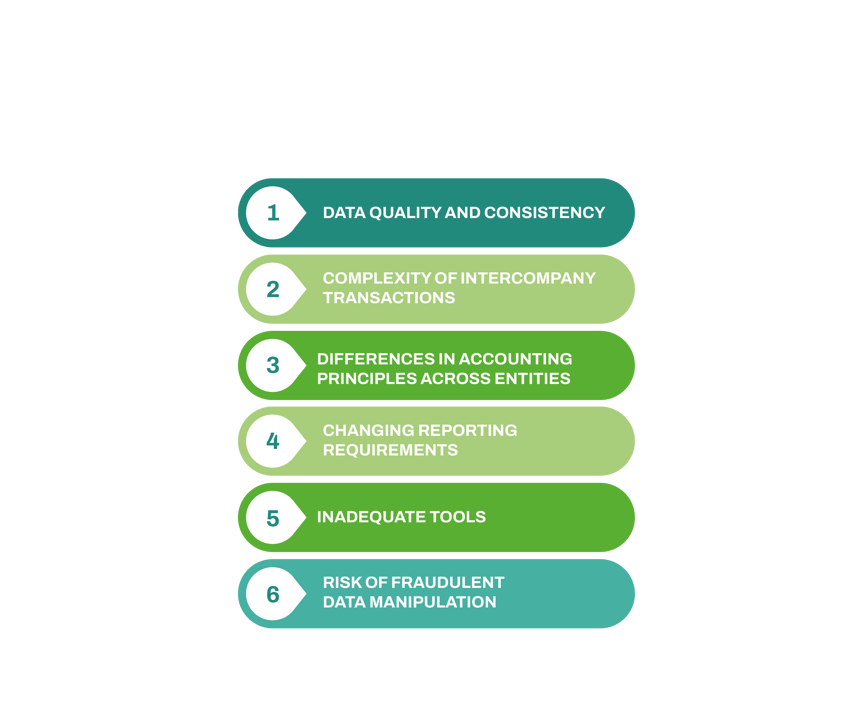

Common Challenges in Financial Consolidation

Financial consolidation process is highly complex and faces several critical challenges that can impact reliability and timeliness.

One of the main obstacles is data quality, which may suffer from manual entry errors or lack of controls over information provided by different group entities.

Efficiency is another major concern. In many companies, Excel is still the go-to tool for financial consolidation.

While powerful, it is not designed for managing complex, collaborative processes that must meet strict regulatory requirements.

Additionally, organisations often struggle to adapt quickly to changing reporting requirements—which may vary by country—not to mention the ever-present risk of data manipulation or fraud.

Financial Consolidation Software: the Path to Automation and Efficiency

Traditionally, consolidation relied heavily on manually gathering data from various legacy systems and compiling

it into a massive Excel file.

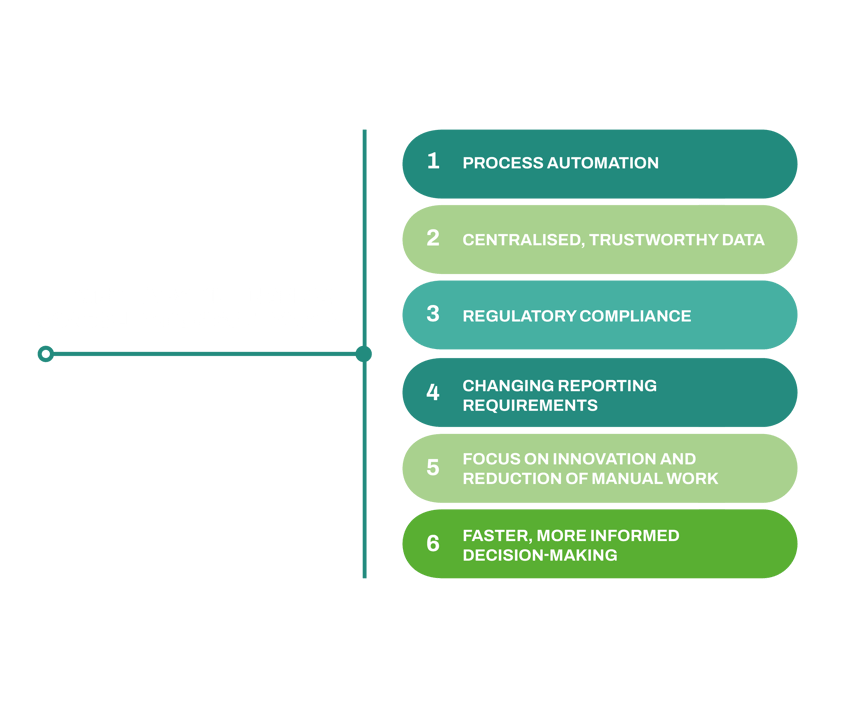

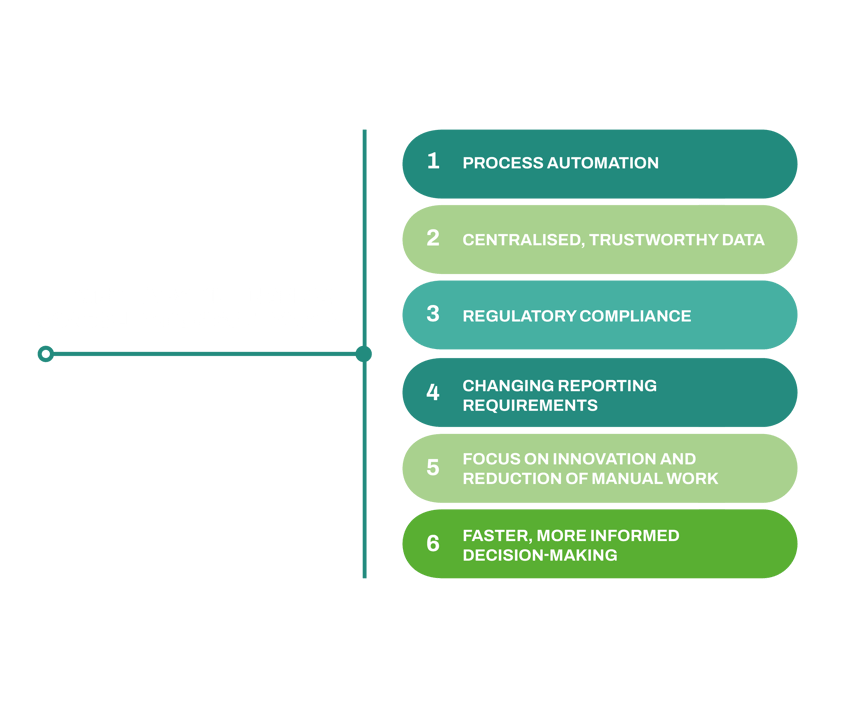

Today, specialised software solutions are available to tackle these challenges. Financial consolidation software integrates with existing ERP systems and automates tasks such as disclosures, aggregations, calculations, compliance, and reporting. This dramatically reduces the manual workload—thanks to innovations such as Business Intelligence tools.

In terms of automation, technologies like Robotic Process Automation (RPA) and Artificial Intelligence (AI) not only improve efficiency but also enhance the reliability of reporting.

Key features of financial consolidation software include:

-

- Automated and standardised workflows.

- Up-to-date currency conversions.

- Comprehensive reporting capabilities.

- Advanced intercompany reconciliation, including automated elimination

of intercompany balances—one of the most challenging aspects of the process.

Avvale: Your Partner in Finance Transformation

Avvale is a strategic partner for companies looking to optimise their financial consolidation processes and, more broadly, embark on a digital transformation journey for their finance function.

With end-to-end expertise in financial transformation, we position ourselves as a 360° partner. We support clients through best-practice process design and the implementation of innovative technologies, guiding them in evaluating, implementing, and maintaining the most suitable solutions.

Every project is unique—but our approach remains consistent. We connect people, processes, and technology to simplify and optimise financial consolidation across different sectors and geographies.

Our methodology leads clients through the entire transformation lifecycle, ensuring each step aligns with their specific needs. We begin by collecting and validating requirements in dedicated stakeholder workshops, then move on to process and IT solution design, always with a technology-agnostic mindset and a strong focus on innovation.

Our approach is not only about efficiency. It also looks ahead—embracing scalability for evolving business needs and sustainability as the foundation for long-term, responsible growth.