Evolve towards operational excellence: Transform your financial processes and reduce invoice processing costs by up to 80% to improve operational efficiency by more than 90%.

The accounts payable process in organizations involves a series of steps including management, validation, and execution of payments. This cycle begins with the receipt of an invoice and culminates in payment to the supplier, passing through various controls and verifications that must ensure accuracy and execution in accordance with established legal and operational deadlines.

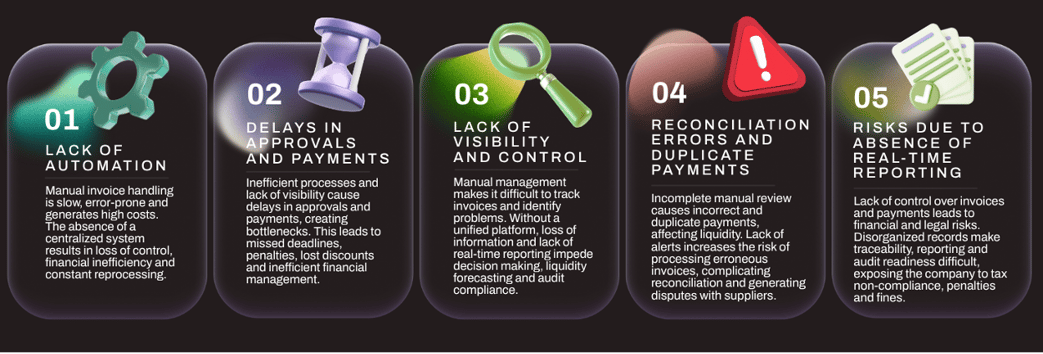

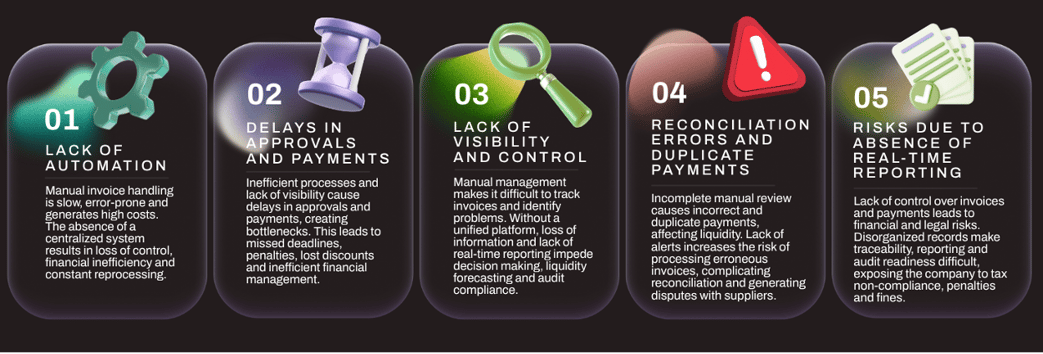

Therefore, organizations are constantly challenged to maintain an efficient and error-free Accounts Payable process where overcoming each of these stages requires highly rigorous and accurate management, and it is precisely this that leads companies to face a number of key challenges in managing their Accounts Payable processes, among which the lack of automation leads to 5 challenges and consequences that impact it.

Strategic Solutions for Accounts Payable: Financial Impact and Operational Efficiency

Understanding the critical challenges organizations face in managing their accounts payable has allowed us to create specialized solutions that generate a tangible and measurable financial impact. Based on extensive experience, we have designed a comprehensive approach focused on addressing the 5 challenges mentioned:

1. Accounts Payable Process Automation

An invoice self-service portal was developed, where the supplier is responsible for indexing their invoice information, saving the accounts payable team time that can be used efficiently to continuously improve processes. Once the indexed invoice information is verified by the ERP system, an automatic accounting process is performed. Additionally, the automation of invoice processing centralizes documents on a digital platform, facilitating real-time access and tracking. With automated workflows, invoices are quickly validated and approved, accelerating payments and avoiding delays. This not only improves operational efficiency but also strengthens supplier relationships and optimizes the company's financial control.

2. Implementation of Efficient Approval Workflows

Automated approval workflows have been implemented, allowing organizations to optimize invoice processing by dynamically assigning documents to the corresponding responsible parties based on predefined business rules. Thanks to the integration of real-time notifications and reminders, approvers receive immediate alerts to review and authorize invoices without interruptions, accelerating decision-making and avoiding operational bottlenecks.

3. Implementation of Controlling

The implementation of an automatic accounts payable process flow with real-time dashboards and advanced analytical reports allows organizations to have a centralized, accurate, and up-to-date view of the status of their accounts payable (AP) processes. Through key performance indicators (KPIs) such as pending invoice volume, average approval times, due dates, and automation levels, financial managers can make informed decisions in real-time, detect and anticipate operational bottlenecks, optimize cash flow, and payment planning. At the same time, analytical reports allow for identifying historical trends and behavioral patterns, monitoring compliance with internal policies and regulatory deadlines. Therefore, having process visibility strengthens strategic decision-making within the accounts payable area. A study by the Institute of Finance and Management (IOFM) confirms this, revealing that manual processing can cost companies up to $15 per invoice. When multiplied by hundreds or thousands of transactions, this cost can have a severe impact on a company's financial results.

4. Optimization of Invoice Control Through Automatic Validation and Alerts

Automatic validation against purchase orders and alerts allows for detecting inconsistencies in invoices before processing, preventing erroneous or duplicate payments. By comparing each invoice with the data recorded in the system, it is verified that amounts, dates, and suppliers match approved orders. In addition, real-time alerts notify of any discrepancies, allowing timely corrections without affecting the workflow. This not only improves financial accuracy but also optimizes accounting reconciliation and reduces the risk of disputes with suppliers.

5. Digital Traceability and Audit Reports: Key to Transparent Financial Management

Digital traceability and audit reports allow for precise and transparent control of all invoices and payments, ensuring regulatory compliance. By storing and recording each transaction in a centralized system, companies can easily access the complete history of documents, approvals, and modifications. Furthermore, automated reports generate detailed information in seconds, facilitating audits and reducing the risk of errors or tax non-compliance. This not only improves operational efficiency but also provides greater security and confidence in financial management.

6. Avvale Intelligent Accounts Payable Solution

Avvale’s Intelligent Account Payable Solution (iAP) modernizes financial management by eliminating manual tasks and reducing errors through AI-powered automation. With automated invoice reading, seamless integration with business systems and optimized workflows, it speeds up the payment cycles and lowers operating costs. Real-time alerts and analysis guarantee total visibility of cash flow, strengthening compliance, efficiency and supporting strategic decision-making.

Accounts Payable Automation: Cost Savings and Greater Efficiency

A report by research firm Ardent Partners highlights that manual processes typically take 10 days or more to process a single invoice, delaying critical payments and potentially leading to lost supplier discounts. Ardent Partners also notes that companies adopting automation achieve on-time payment rates of 96%, compared to 75% for those relying on manual methods.

Therefore, cost savings are perhaps the most tangible benefit. By eliminating the need for extensive manual intervention, companies can substantially reduce invoice processing costs. The Institute of Financial Management (IOFM) estimates that companies implementing automation can reduce costs to as little as $2 per invoice, a drastic reduction compared to manual methods.

We know that one of the challenges that generate the most indirect costs in invoice processing has to do with frequent manual errors made by people in the accounts payable area, as indicated by a prominent source from SAP Community: On average, 3.6% of invoices have serious errors, but leading companies using intelligent accounts payable (AP) solutions reduce this to under 1%. These solutions improve key AP metrics like cost, fraud detection, duplication, approvals, and vendor satisfaction. They also help capture early payment discounts (e.g., 2/10 net 30), saving money by paying invoices early.

Likewise, when an automated process is in place to improve relationships with suppliers, it is possible to create significant financial benefits for the company, such as early payment discounts, which result in significant savings with a stable cash flow. Suppliers also benefit by accelerating their cash flow and reducing the risk of late payments, as shown by PayStand.

| Indicator |

Manual Processing |

Automated Processing |

Improvement % |

| Cost per invoice |

Up to $15 USD |

From $2 USD |

Up to 80% reduction

in cost per invoice |

| Average processing time |

10 days or more |

10 minutes |

99% reduction

in processing time |

| On-time payment rate |

75% |

96% |

Up to 21% improvement

in payment timeliness |

| Serious error rate |

3.60% |

Less than 1% |

More than 70% reduction

in serious errors |

At this point, it's crucial to ask: How much money has your company lost due to processing errors or payment delays? Or how much time does your team spend searching for information and approving invoices?

Although these problems may seem minor, over time they become significant financial and operational burdens. Only by moving towards automation can efforts and objectives be focused on achieving operational excellence. Therefore, automating the accounts payable process is presented as a strategic solution that promotes efficiency by processing invoices quickly and reliably, eliminating the need for manual information indexing and significantly reducing errors, by offering real-time visibility of invoice status and generating automatic reports, facilitating decision-making and focusing the business on much more efficient financial management, where workflow optimization improves relationships with suppliers by ensuring accurate and timely payments.

As we've seen, the inherent digitalization of automation also leads to a drastic reduction in errors and re-processes, which translates into more efficient use of resources and less waste. Furthermore, the complete digital visibility and traceability offered by an automated system not only optimizes financial management but also facilitates regulatory compliance and promotes transparency. Adopting this technology not only positions companies as innovators but also lays the groundwork for more solid and conscious growth, aligned with the demands of a market increasingly focused on social and environmental responsibility.

Ultimately, accounts payable automation is the path to a more efficient and responsible operation. Beyond the obvious financial gains, this is a strategic opportunity that directly impacts business sustainability, as by reducing paper consumption and eliminating the need for printing, physical files, and postal mail, companies reduce their carbon footprint and actively contribute to the circular economy.

Transform with Avvale

At Avvale, we are open to starting this conversation to help companies on their journey toward Financial Evolution and improve their relationships with suppliers so that it is reflected in their operational efficiency and business intelligence in their audit, reconciliation, and payment processes.

Are you ready to drive your company towards an agile, circular, and sustainable future, with operational excellence, to improve your supplier relationships and reduce invoice processing costs?