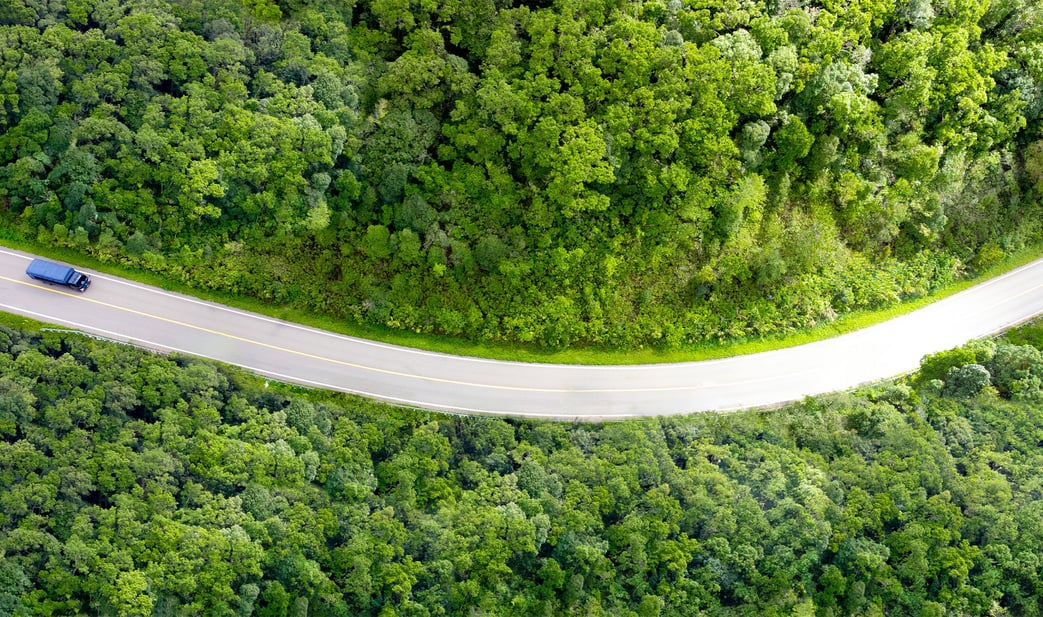

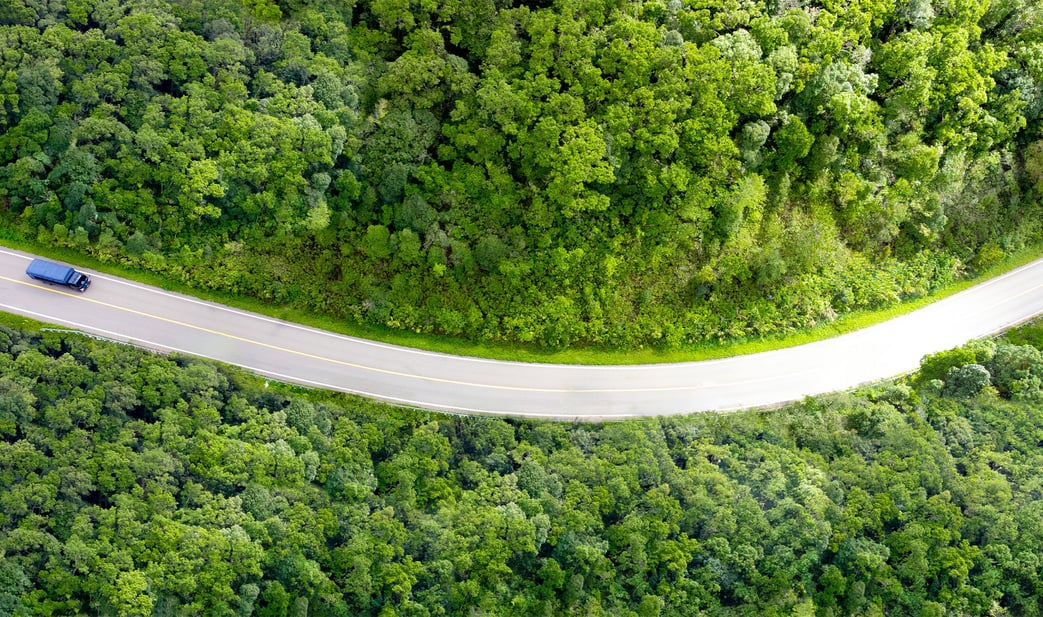

When we talk about sustainability, the focus is often on internal efforts, including process optimisation, energy savings, and green initiatives. However, the reality is much broader. A significant share of a company’s environmental and social impact originates across the supply chain through its suppliers, chosen materials, transportation practices, and working conditions across different tiers.

In short, an ESG strategy is only credible if it extends to the entire supply chain — because even the most virtuous commitment loses value if partners do not meet minimum standards in environmental practices, responsible governance, and alignment with company values.

According to some estimates, companies have direct visibility into only 7% of their supply chains. The remaining 93% lies in the shadows — and that’s where major risks may be hiding, capable of severely impacting a company’s reputation and regulatory compliance.

ESG and Supply Chain: A Closer Look at Regulations

The growing focus on ESG criteria in supply chains is no longer just about corporate responsibility or brand positioning. Today, it’s a matter of compliance. With the introduction of new legislative frameworks, the European Union has started to define stricter ESG requirements for businesses.

CSRD - Corporate Sustainability Reporting Directive

Among the most significant regulations is the Corporate Sustainability Reporting Directive (CSRD), which marks a major turning point. Starting with the 2024 fiscal year, and expanding in scope over time, large companies — especially those already subject to the Non-Financial Reporting Directive (NFRD) — are now required to report their environmental, social, and governance impacts according to harmonised EU standards.

This reporting no longer applies only to a company’s internal operations, but extends to its supply chain and external partners, who must be assessed in terms of environmental risks, working conditions, human rights, and other key factors.

It’s not just about transparency: the CSRD mandates that ESG elements be integrated into corporate strategy and governance, influencing processes, procurement, risk management, and supplier relations. As often happens, this triggers a domino effect — involving not only directly regulated businesses, but also suppliers, subcontractors, logistics providers, and production partners. All players in a regulated value chain must provide ESG assurances to continue doing business with companies subject to reporting obligations. Ignoring this shift means exposing oneself to both reputational damage and a serious loss of competitiveness.

Corporate Sustainability Due Diligence Directive (CSDDD)

CSDDD is complementary to CSRD, but shifts the focus from transparency to action. The Directive establishes a legal obligation of due diligence along the entire value chain (both direct and indirect suppliers), requiring companies to carry out concrete activities – such as audits, corrective action plans, and ad hoc contractual clauses – to identify, prevent, mitigate, and put an end to negative impacts on human rights and the environment.

Sector-specific regulations

In addition to cross-cutting frameworks such as CSRD and CSDDD, the European Union is introducing sector-specific regulations that directly impact supply chains.

A relevant example is the EU Deforestation Regulation (EUDR), which from 2024 requires companies to ensure that certain products — including cocoa, coffee, timber, rubber, soy, and beef — do not originate from areas deforested after 2020. This implies precise geographical traceability back to the source of the material and a due diligence system for suppliers, especially in high-risk countries.

A similar impact comes from the EU Battery Regulation, which requires ESG traceability of the supply chain for critical materials (lithium, cobalt, nickel), including working conditions and environmental impact.

Supply Chain Due Diligence: the fundamental steps

Measuring supply chain sustainability is a complex challenge that requires vision, structure, and the right tools. The biggest difficulty lies in evaluating what is largely outside a company’s direct control. Simply asking suppliers to sign a declaration is not enough.

To this end, a declaration of intent from suppliers is not sufficient; it is necessary to structure an organic due diligence process that combines a rigorous screening methodology, the definition of KPIs aligned with international standards, and enablement through traceability and risk monitoring technologies.

Mapping the Value Chain

The first step is to create a comprehensive map of your supply chain — starting with direct suppliers, but going further when needed. Often, the most critical ESG risks lie in deeper tiers of the chain, which are harder to monitor but strategically important to understand.

It is what comes from where, but also information and contractual responsibility flows. This helps whether transparency and traceability exist across the chain. The goal is nose every subcontractor contract, but to assess whether ESG standards travel downstream effectively.

Given the impossibility of monitoring all partners in the same way, the company could adopt a risk-based approach, which translates into the creation of risk maps (e.g., geographical, category-based, operational…), focusing on the most critical links. The use of digital tools is an enabling factor at this stage. Supplier Risk Management (SRM) platforms leveraging AI can cross-reference supplier data with external risk databases in real time to support dynamic risk classification.

What data to collect: choosing the right ESG indicators

Defining what data to collect is one of the most delicate aspects in evaluating ESG in the supply chain. There is no universal list: it is necessary to identify the most relevant indicators based on the sector, the supplier’s position in the chain, the level of risk, and the potential impact. International guidelines — such as GRI standards, sector-specific SASB criteria — provide useful references, but they must be translated into concrete, operational KPIs.

The first step is a materiality assessment, ideally applied also at the supplier or product category level. For a raw material supplier in a high-risk country, priority indicators might include:

- Traceable geographic origin

- Presence of environmental or social certifications

- Guaranteed union rights

- Policies on child labor and minimum wage

- Use of water and natural resources

- Waste generation

- Energy consumption per unit of product

For energy-intensive suppliers or those involved with critical raw materials, other relevant KPIs include specific carbon footprint, climate transition plans, use of renewable energy, or percentage of recycled content in materials.

On the governance side, the following elements are considered:

- Anti-corruption policies

- Contract transparency

- Whistleblowing mechanisms

- Adherence to supply chain codes of ethics

The challenge is not only to define these indicators case by case, but to standardize, digitize, and make them comparable over time and across suppliers. This is where dedicated platforms become essential, as they offer templates, workflows, and scoring logic tailored to sector, risk level, and the ESG maturity of the supplier.

Engaging Suppliers and Gathering ESG Data

Monitoring ESG across the supply chain requires active engagement with suppliers. It is not just about asking for data — it is about building a relationship grounded in transparency and collaboration.

Companies must implement clear, shared methods for data collection, including structured questionnaires, self-certifications, reports, and periodic audits. Supporting suppliers — especially those in complex environments — is crucial to help them understand expectations and improve their ESG performance over time.

Leveraging Digital Tools and Platforms for Data Collection

The ESG data collection and management phase represents the most operational aspect of supply chain governance. To ensure effectiveness, continuity, and traceability over time, it is essential to adopt digital tools capable of standardizing information flows and supporting data-driven decision-making processes. Among the most effective solutions are:

- Collaborative supplier portals, which allow supply chain partners to upload ESG documentation, certifications, and indicators in a structured and verifiable way.

- Automated scoring workflows, which facilitate supplier evaluation, the identification of gaps against expected standards, and the definition of intervention priorities.

- Targeted support programs, aimed at the most critical or high-risk suppliers, which include corrective actions, technical training, and shared improvement roadmaps.

Collected data must then be analysed and used not just for reporting, but to inform strategic decisions that enhance overall business sustainability.

ESG Supply Chain Governance: Avvale’s Role

Avvale positions itself as a strategic partner for organizations aiming to strengthen their ESG performance by integrating sustainability and risk management through a structured consulting approach, solid operational processes, and proprietary digital solutions.

Our approach is distinguished by the ability to combine technological expertise with a deep understanding of ESG dynamics, business challenges, and constantly evolving regulations. We therefore offer 360-degree support, which includes the development of an integrated ESG strategy, centralized management of ESG data from multiple sources, and reporting tools that support alignment with the main international frameworks such as GRI, SASB, CSRD, and TCFD.

In addition, Avvale includes ESGeo, a company specialized in sustainability consulting and ESG data governance. ESGeo provides a team of certified analysts who support organizations in double materiality analysis, compliance with European regulations, supply chain due diligence, and development of customized ESG assessment models.

The ESGeo suite optimizes the entire process from data collection to report creation, enabling companies to identify and prioritize the most relevant topics, compare performance with competitors and industry standards, engage managers in sustainability goals, and strengthen relationships with investors, rating agencies, and clients through continuous and transparent impact monitoring.